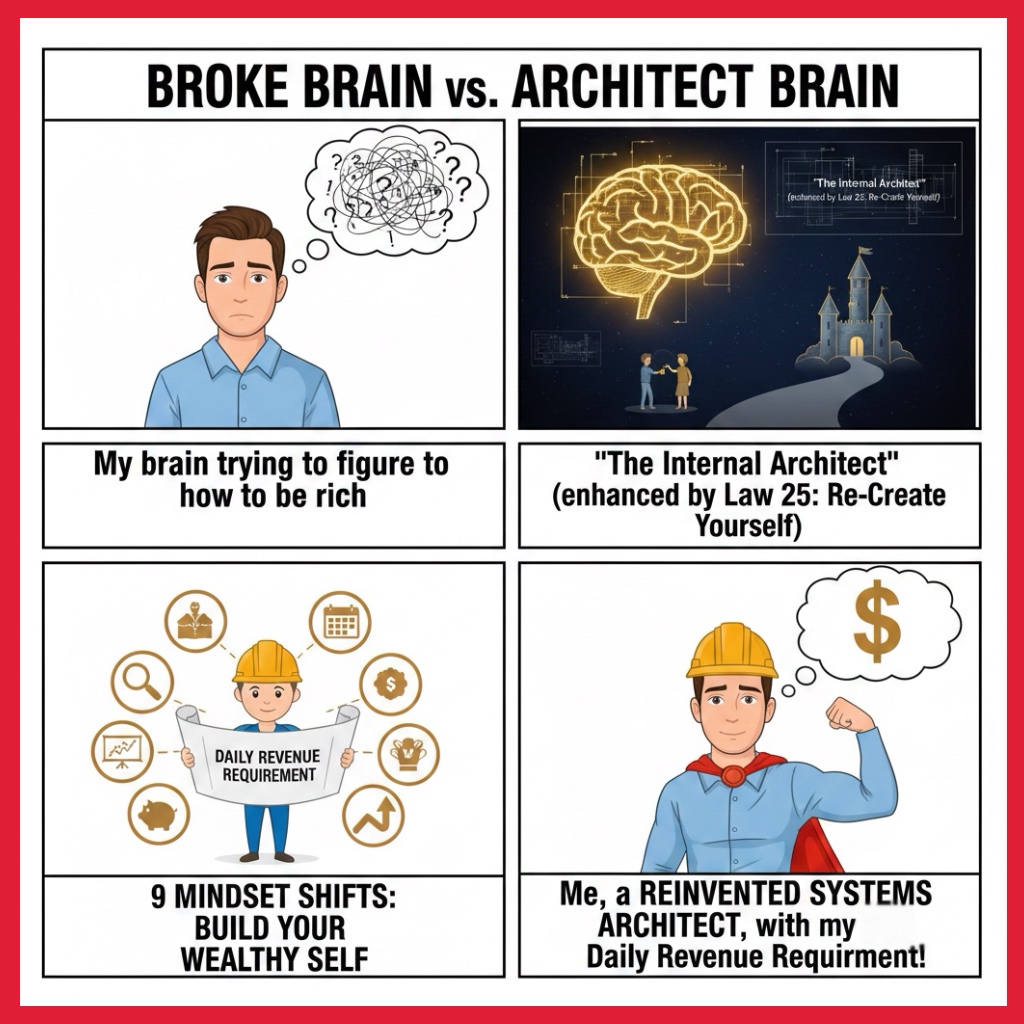

The Internal Architect

🌟 The Internal Architect: 9 Mindset Shifts for Financial Abundance

(Enhanced by Law 25: Re‑Create Yourself)

Wealth is built in the mind long before it appears in your accounts. High earners think in targets, systems, and compounding gains—not in hopes or luck. To achieve true financial abundance, you must master the art of self‑transformation.

Use these nine mindset shifts—enhanced by the power of self‑reinvention—as your internal operating system for lasting prosperity.

👑 The Reinvented Self: Law 25 — Re‑Create Yourself

You cannot become financially abundant while being the same person who created your current limitations. Radical growth demands that you consciously shed outdated financial identities and reforge yourself into a disciplined, focused, high‑performing wealth creator. Refuse to let your past or other people’s perceptions dictate the ceiling of your future.

The 9 Shifts

1. Turn Goals Into Daily Targets (The Daily Operator)

Big visions mean nothing without daily execution. Translate your annual income goal into a Daily Revenue Requirement (DRR) so you know exactly what “winning today” looks like. Consistent hits to that number hard‑wire the habits of your future identity.

Action: Divide your annual goal by 365. Track and hit that number every day.

2. Set a Non‑Negotiable Net‑Worth Target (The Ultimate Visionary)

Intent beats hope. Choose a specific net‑worth target and target age so every decision aligns with a clear destination. This is the “New You” in measurable form.

Action: Write the number down. Keep it visible where you’ll see it daily.

3. Use Specific Affirmations (The Inner Programmer)

Your brain looks for what it believes matters. Specific, time‑bound affirmations program your reticular activating system to spot opportunity aligned with your reinvented self.

Action: Write one “I am” or “I have” affirmation linked to your target. Set it as your phone lock screen.

4. Visualize Your Future Day (The Mental Rehearsal)

Visualization removes emotional distance from your goal. Each vivid mental rehearsal conditions your subconscious to treat success as familiar terrain, not a distant dream.

Action: Spend 5 minutes each morning walking through a “Future Day” as your wealthy, self‑reinvented self.

5. Attach Emotion to Your Numbers (The Meaning Maker)

Wealth sticks when it means something. Numbers stimulate logic, but emotions drive persistence. Emotional stakes prevent you from reverting to your old identity during challenges.

Action: List what your wealth will eliminate (stress, scarcity) and what it will unlock (choice, freedom, purpose).

6. Give Your Brain Clear Parameters (The Executive Command)

Clarity activates your inner executive. Feed it data: where you are, where you’re going, and by when. The awareness of the gap becomes your internal mandate.

Action: Calculate your current net worth, your target, and the number of years to bridge the gap.

7. Build a Vision Board of Outcomes (The New Persona’s Stage)

Images organize your focus. Surround yourself with visual proof of the life you’re constructing. The board becomes the stage where your new financial persona performs daily.

Action: Create a board—digital or physical—filled with images of the lifestyle your financial abundance will fund.

8. Apply the 1% Rule (The Constant Incrementalist)

Small, repeatable improvements compound over time. Each 1% shift moves you further from your old financial identity and closer to your wealth‑optimized self.

Action: Improve one financial habit—earning, saving, or learning—by 1% this month.

9. Design an Environment That Makes Success Easy (The Systems Architect)

Systems outperform willpower every time. Build an ecosystem that automates good behavior and eliminates friction. When the environment shifts, identity follows.

Action: Remove one spending trigger and automate one positive money action, like weekly investing.

Start Here

Begin with Pillar 1—define your Daily Revenue Requirement. Anchor your focus to that number. Remember: portfolios follow mindsets, not the other way around. The reinvented self always leads; wealth simply catches up.

Comments

Post a Comment