The American Wealth Engine:

How to Utilize the World’s Most Resilient Financial System

In any given week, you can open X and see the same script on repeat.

The dollar is dying.

America is finished.

The game is rigged.

The middle class is dead.

Scroll long enough and it feels less like financial commentary and more like a psychological operation designed to produce one thing: paralysis.

And yet—quietly, in the background—millions of people are doing the opposite. They’re using this “rigged” system to:

- build real net worth,

- exit jobs they hate,

- start businesses,

- buy assets that pay them while they sleep.

Same country. Same dollar. Same “system.” Totally different outcomes.

This isn’t about optimism. It’s about mechanics.

The United States—flawed, chaotic, politically hysterical—is still the most powerful wealth-building engine for the individual in human history. Not because it’s fair. Not because it’s moral. But because of how its financial, legal, and economic systems are wired.

Most people are standing on a launchpad and complaining about gravity.

This is the manual for the launch sequence.

The Quiet Miracle: What the “American Wealth Engine” Actually Is

Let’s strip away the patriotism and the panic.

When I say “American Wealth Engine,” I’m not talking about flags and fireworks. I’m talking about a set of interlocking systems that, together, make it unusually possible for a regular person to turn work into capital, and capital into autonomy:

- Deep, accessible capital markets

- Strong (comparatively) property rights and contract enforcement

- A massive consumer market and entrepreneurial culture

- A global reserve currency (the dollar) that the world still wants

- A tax and credit system that quietly rewards certain behaviors

You don’t have to love the system to use it.

You just have to understand the game board.

Think of America less as a country, more as a platform:

- Other countries may have beauty, tradition, community.

- The U.S. has something more cold-blooded: a gigantic, mostly-stable machine that lets you convert effort + time + discipline into owning pieces of the machine itself.

If you understand how that machine works—and you’re willing to play a longer game than your social media feed—you have an edge that billions of people on this planet simply don’t.

Let’s map that edge.

The Game Board: 5 Structural Advantages You Can Actually Use

These aren’t abstract “America is great” talking points. These are levers you can pull.

Advantage #1: Deep and Open Capital Markets

Most people experience the stock market through memes:

stocks go up, stocks go down, everything is manipulated.

Step back and look structurally.

The U.S. gives you:

- 401(k)s and IRAs

- low-cost index funds and ETFs

- broad, cheap access to ownership in thousands of companies

- legal and regulatory infrastructure that, while imperfect, is light-years ahead of much of the world

Game-theoretically, this is bizarre.

You can:

- earn a paycheck at Company A,

- take a slice of that paycheck,

- and automatically buy tiny pieces of hundreds or thousands of other companies—across industries, geographies, and sectors—every two weeks.

You are not stuck betting your entire life on one employer, one industry, one town.

How to use it (in plain language):

- Contribute to your 401(k)/403(b) at least up to the employer match. That’s free money.

- Use broad index funds (like total market or S&P 500 funds) rather than chasing hot stocks.

- Automate contributions so you don’t “decide” each month. The game is rigged in favor of consistency.

You don’t have to become a stock picker. You just have to become an owner.

Most people never cross that line.

Advantage #2: Cheap Leverage (If You Don’t Use It to Destroy Yourself)

Credit in America is a double-edged sword.

On one side:

- 20%+ APR credit cards, BNPL traps, auto loans that quietly eat your future.

On the other side:

- 30-year fixed-rate mortgages, relatively low interest business loans, lines of credit—tools that let you control assets much larger than your savings alone.

In game theory terms, leverage is a force multiplier. It lets you amplify your moves.

- Use it to finance consumption (cars, gadgets, lifestyle)?

You amplify fragility.

- Use it to control productive assets (a reasonably priced home, a business, a cash-flowing project)?

You amplify resilience.

How to use it intelligently:

- Treat high-interest consumer debt as a financial house fire. Put it out first.

- Protect and slowly build your credit score; it’s your “reputation score” with the capital system.

- When you do borrow big (mortgage, business), run the numbers pessimistically:

- “If income drops 20%, can I still survive this payment?”

- “If rates rise later, what happens?”

The system rewards people who use cheap, long-term, fixed-rate debt to buy productive assets—and punishes those who use floating, expensive debt to buy status.

Both are possible in America. You choose which game you’re playing.

Advantage #3: The Tax Code as an Incentive Map

Most people experience taxes as punishment.

But zoom out. The U.S. tax code is not a moral document. It’s an incentive map.

It quietly says:

- “If you save for retirement here, we’ll tax you less.”

- “If you invest long-term, we’ll tax your gains differently than your paycheck.”

- “If you start a business and take real risk, we’ll allow certain deductions.”

- “If you buy health insurance or save in an HSA, we’ll treat that money more gently.”

You don’t have to love it. But if you ignore it, you’re handicapping yourself.

Examples of levers (educational, not advice):

- Pre-tax retirement accounts (401(k), traditional IRA): lower your taxable income now; pay taxes later.

- Roth accounts: pay tax now, let gains potentially grow tax-free.

- Long-term capital gains: if you hold assets over a year, they can be taxed more favorably than short-term flips.

- Small business / side business: certain legitimate expenses can be deducted against business income.

You don’t need to become a tax strategist.

But you do need to accept one reality:

The system is telling you, in plain numbers, which behaviors it wants from you.

Save, invest, build, take structured risk—and the friction decreases.

Ignoring that is like refusing to read road signs and then complaining about getting lost.

(Standard note: Everything here is for educational purposes only. Talk to a qualified tax pro for your specific situation.)

Advantage #4: Career Upside and Mobility

Is the American labor market perfect? No.

Is it more flexible and opportunity-rich than most of the planet? Yes.

Structurally, you have:

- The ability to change companies without needing government permission

- The option to reskill into entirely new fields through bootcamps, community colleges, certifications, online courses

- A culture where lateral moves, promotions, and job-hopping for higher pay are normal

Career is your primary wealth engine for most of your life.

The U.S. job market makes it unusually possible to:

- increase your income meaningfully within a decade

- pivot out of dead-end roles

- compound skills and compensation, not just seniority

Where people get stuck is mindset:

- “I’m trapped in this role forever.”

- “My degree defines my entire future.”

- “Switching industries at 30/40/50 is impossible.”

These are beliefs, not laws.

In a country with this much economic churn, the more accurate mental model is:

“I sit on a massive labor market. My job is to position myself where that market overpays for the skills I can build.”

That’s Career Economics—one of the core pillars of The Resilient Dispatch.

Advantage #5: Dollar-Denominated Stability

For over a decade, financial commentary has kept one ghost on retainer:

the imminent collapse of the U.S. dollar.

Every crisis, every rate hike, every geopolitical tremor becomes “proof” that the dollar is done and America is finished.

Here’s the part that rarely trends:

- The dollar is messy, but it is still the world’s reserve currency.

- Global trade, sovereign reserves, corporate borrowing—massive chunks of this are still dollar-based.

- When the world panics, it doesn’t rush into U.S. Treasuries. It rushes into U.S. Treasuries.

Could this change one day? Sure.

But building your personal financial strategy on “The dollar will be worthless in five years” is less a risk-management plan and more a self-sabotage script.

As an individual trying to build resilience, what this means is:

- You operate inside a currency system that the world still lines up to hold.

- Your savings and investments sit on top of a deep, liquid, globally demanded foundation.

That doesn’t make you invincible. It does make the playing field far more stable than the average doom-thread suggests.

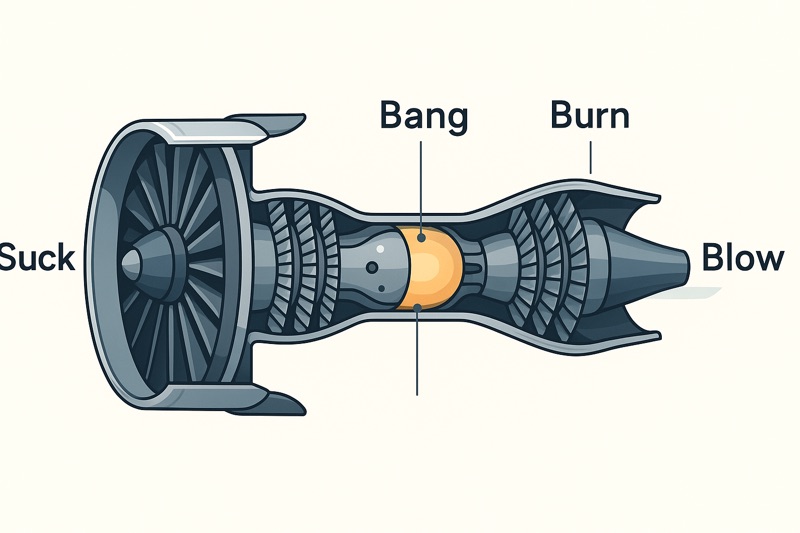

The Turbine Model: Engineering Continuous Thrust

To understand how to use the American Wealth Engine, you have to understand how a turbine works. Unlike a piston engine that fires in discrete “strokes,” a turbine is a continuous‑flow machine. It runs four stages simultaneously: Suck, Squeeze, Burn, Blow.

If airflow is restricted at any point, the engine suffers a compressor stall — power collapses instantly. Your financial life follows the same physics. Here’s how to engineer your personal turbine inside the American system:

1. Suck (Intake)

The Mechanic: The front fan pulls in massive volumes of air. The more mass flow the engine ingests, the more thrust it can generate.

The Finance: This is your Opportunity Inflow. In the U.S., intake is unmatched: the world’s most liquid job market, upward mobility, and access to capital through 401(k)s, IRAs, and employer incentives.

The Resilient Move: Most people operate with a restricted intake — one stagnant paycheck. A turbine needs wide‑open valves. Maximize every dollar the system lets you keep through employer matches and tax‑advantaged space.

2. Squeeze (Compression)

The Mechanic: Air is forced through high‑pressure stages, packed into a dense, volatile core. By the time it reaches the combustor, it’s primed for explosive energy release.

The Finance: This is Capital Concentration. Living below your means creates the pressure required for growth.

The Resilient Move: Without compression, you just have a breeze moving through a tube. Set your savings rate. Focus your resources. This is where raw earnings are squeezed into potential energy.

3. Burn (Combustion)

The Mechanic: Fuel is injected into compressed air and ignited. The expansion spins the turbine blades, which power the intake fan — a self‑sustaining loop.

The Finance: This is Compounding and Execution. The steady burn of your capital working inside the S&P 500 or scaling business equity.

The Resilient Move: In a turbine, the burn never stops. In America’s deep markets, this is incredibly efficient — unless you interrupt it. Don’t starve the engine with panic‑selling or constant tinkering. Let the internal turbine pull in more intake for you.

4. Blow (Exhaust & Thrust)

The Mechanic: High‑velocity exhaust is expelled to create thrust. If the exhaust path clogs or creates back‑pressure, the engine suffocates.

The Finance: This is Risk Management and Shedding. Clearing out anything that kills thrust: high‑interest debt, zombie subscriptions, dead‑end career paths.

The Resilient Move: You need a Blow phase to stay agile. This includes your The Walk-Away Fund — the thrust that lets you vent a bad situation and reset your intake. If you can’t blow off dead weight, your engine will eventually seize.

The Misplay: How Americans Turn a Launchpad into a Hamster Wheel

So if the structural backdrop is this strong, why are so many people stuck?

Because structure is only half the equation. Strategy is the other half.

Most Americans run a default script that looks like this:

1. Get a paycheck.

2. Inflate lifestyle to match (or exceed) the paycheck.

3. Finance the gap with high-interest debt.

4. Invest sporadically, if at all.

5. Let career drift, instead of intentionally moving toward higher-value skills.

6. Carry zero meaningful liquidity, so every shock becomes a crisis.

They turn the most powerful wealth engine on earth into a very fancy treadmill.

In game theory terms, they’re:

- playing a status game instead of a survival + accumulation game,

- optimizing for how life looks in the short term instead of how their position compounds in the long term.

Then, when the treadmill feels unbearable, it’s easier to blame:

- the Fed,

- the elites,

- the government,

- the “dying system”—

than to admit that maybe, just maybe, their playbook needs a rewrite.

That’s where resilience comes in.

The Resilient Playbook: Turning the System to Your Advantage

Let’s build a counter-script.

This isn’t about perfection. It’s about shifting from fragile by default to resilient on purpose.

Step 1: Design Your Personal “Wealth Stack”

Think of your financial life like an engineered system, not a pile of random accounts.

A simple, resilient Wealth Stack:

1. Walk-Away / Emergency Fund- Target: 3–6 months of essential expenses (more if your income is volatile).

- Role: Shock absorber. Protection against job loss, health issues, sudden expenses.

- This is your first line of real leverage: the ability to say “no” without collapsing.

2. High-Interest Debt Extinguisher - Any 15–25% APR debt is a five-alarm fire.

- Paying this off is a guaranteed return that markets can’t promise you.

3. Core Investment Engine - Automated monthly contributions to broad index funds (401(k), IRA, taxable brokerage).

- Think “default setting”: your money goes here unless there is a compelling reason otherwise.

4. Strategic Upside Layer (optional once foundation is strong)

- Targeted skill-building (certifications, courses).

- Side business, small experiments, high-upside but controlled bets.

Resilience first. Optimization second.

You don’t build a skyscraper on quicksand and then ask which windows look best.

Step 2: Convert Your Income Stream into a Capital Engine

The American system gives you access to capital markets, retirement accounts, and leverage—if you can free up cashflow to use them.

That means your job is not just “where you spend your day.”

It’s the funding source for your eventual autonomy.

A useful mental model:

“I tax myself 20–30% to fund Future Me.”

Before money disappears into lifestyle, you:

- Skim off a fixed percentage (say, 15–30% depending on your situation).

- Route it into your wealth stack:

- walk-away fund (until full)

- then high-interest debt

- then core investments.

This transforms your paycheck from something that arrives and vanishes into something that builds a position.

You stop being just labor. You become capital.

Step 3: Map the Tax and Credit Systems to Your Advantage

Once cashflow is under control, you start telling the system what game you’re playing.

- Use tax-advantaged accounts that fit your situation (401(k), IRA, Roth, HSA if available).

- Understand—at a basic level—how your contributions affect your tax bill.

- Protect your credit: pay on time, keep utilization low, avoid unnecessary accounts.

This isn’t about exploiting loopholes. It’s about not fighting the current.

If the system says:

- “Invest here and we’ll tax you less,”

- “Behave like this and we’ll lend to you cheaper,”

you don’t have to like it. You just have to decide whether you’re willing to leave that on the table.

Again: this is educational, not advice. But ignoring incentives is a sure way to make the game harder than it needs to be.

Step 4: Build Redundancy: Liquidity, Skills, and Optionality

Resilience is not just about money. It’s about degrees of freedom.

A Resilient American Wealth Engine has three redundancies:

1. Liquidity - Cash or near-cash you can access quickly without wrecking your life.

- This is your Walk-Away Fund, your ability to refuse a bad deal, your buffer against panic.

2. Skills - The number of ways you can ethically and sustainably earn money.

- More skills = more negotiation power, more job mobility, more side income potential.

3. Optionality - The ability to change cities, industries, companies, or even lifestyles.

- Lower fixed expenses and high savings rates buy you this option.

Optionality is underrated.

In a system with this much economic churn, the most powerful position isn’t “maximally optimized.” It’s:

“I can move, change, adapt, or walk away—and I have the resources and skills to survive doing it.”

That’s resilience.

Step 5: Define Your “Resilient Threshold”

“Being rich” is vague. “Financial freedom” is vague.

Vague targets don’t generate action.

Instead, define levels of resilience in concrete terms:

- Level 1: Basic Stability - 1 month of expenses in cash

- No high-interest credit card balances

- At least 5–10% of income going to savings/investment

- Level 2: Real Buffer - 3–6 months of expenses in cash

- All toxic debt gone

- 15–20%+ of income going into investments/wealth building

- Level 3: Strategic Autonomy - 12+ months of expenses in liquid or near-liquid assets

- Meaningful investment portfolio (size will vary by person and location)

- Multiple income sources (job + side income and/or portfolio income)

These aren’t rigid rules. They’re checkpoints.

Your question becomes:

“What is my current level of resilience?”

“What is the next level?”

“What’s the next single move that gets me closer?”

You’ve turned your life into a game with clear levels instead of a fog of anxiety.

Case Study: Two Americans on the Same Street

Let’s make this concrete.

Same street.

Same city.

Same starting salary: $70,000.

Person A: The Hamster Wheel Player

- Buys a new car with a big payment to “celebrate” the job.

- Rents a luxury apartment at the edge of their budget.

- Puts vacations, furniture, and “emergencies” on a credit card.

- Pays the minimum on 20% APR debt.

- Contributes almost nothing to retirement because “I’ll do it when I make more.”

Fast forward 10–15 years:

- Salary: higher, maybe $100–120k.

- Net worth: near zero or negative.

- Every job negotiation is done from fear because they can’t afford a gap in paychecks.

- Lifestyle is nice on the surface; structurally, they’re fragile.

Person B: The Engine Player

- Keeps a modest car or buys used; payment or purchase sized to be boring, not impressive.

- Chooses a livable but not aspirational apartment.

- Builds a 3–6 month Walk-Away Fund over the first few years.

- Kills high-interest debt as a top priority.

- Contributes at least to the 401(k) match, then slowly increases the percentage.

- Uses promotions and raises not to inflate lifestyle, but to increase savings/investment rate.

Fast forward 10–15 years:

- Salary: similar range, maybe $110–130k.

- Net worth: six figures or more, depending on the market and savings rate.

- Has options: can change jobs, take a sabbatical, walk away from a toxic manager.

- May own a home; investments have had a decade-plus to compound.

Same country.

Same “rigged system.”

Different playbook.

The structural advantages of the U.S. didn’t pick favorites.

Person B simply used them.

“But What About Inequality, Stagnant Wages, and Debt?”

We need to be adults about this.

- Inequality is real.

- Housing and healthcare are brutally expensive in many places.

- Student loans and medical debt can strangle people before they even start.

The point of this article is not:

“Anyone can be rich if they just try hard enough.”

The point is:

“Given the system we’re in, there are structural levers you can pull to make your position more resilient than it would otherwise be.”

For some people, the first “wealth move” won’t be investing in index funds. It will be:

- getting current on rent,

- negotiating a medical bill,

- paying down a predatory loan,

- building a $500 buffer so the next car repair doesn’t become a catastrophe.

That still counts. That is still playing the game better than the default.

Resilience is not reserved for the already-comfortable. It’s a survival strategy for people who can’t afford to be naive about how this machine works.

Use the Engine or Complain About the Smoke

The American system is not a saint. It’s a machine.

It has winners and losers. It has injustices. It has volatility and ugliness and periods where everything feels like it’s on fire.

But step back:

- You live in a country where you can own tiny tradable pieces of the most profitable companies on earth through an app.

- You can move cities, change careers, go back to school at 35, start a side business from your laptop.

- You operate inside the currency that the world still runs to in a storm.

That doesn’t mean you’ll automatically win.

It does mean you’re standing on one of the most powerful wealth platforms that has ever existed—and you have a choice:

- Spend the next decade doom-scrolling about how broken it is.

- Or spend the next decade learning the rules, pulling the levers, and building something that can survive shocks.

You don’t need a perfect plan. You need a first move.

In the next 7 days, pick one:

- Open (or increase) an automatic contribution to a retirement or investment account.

- Map out your basic Wealth Stack on paper: where your cash, debt, and investments actually sit.

- Start a $500–$1,000 Walk-Away Fund, even if it’s $20 at a time.

- Audit one lifestyle expense that’s pure status, and redirect that money into your future instead.

The engine is running with or without you.

The question is simple: Are you letting it carry you—or run you over?

Next Dispatch Missions (Optional Reading):

If this article resonated, you may want to explore:

The Walk-Away Fund: Why Liquidity Is the Only Real Leverage

The Sunk Cost Trap: How to Identify Your Financial Zombies & Reallocate for Maximum Growth

These pieces drill deeper into two of the most important levers in the American Wealth Engine: liquidity and the courage to kill bad bets.

**Disclaimer:** This article is for informational and educational purposes only. It is not financial, investment, tax, or legal advice. Everyone’s situation is unique—consider consulting a qualified professional before making major financial decisions.

Comments

Post a Comment