Some Things Are Built to Last: Stewardship in the Age of Recycled Panic

Some Things Are Built to Last: Stewardship in the Age of Recycled Panic

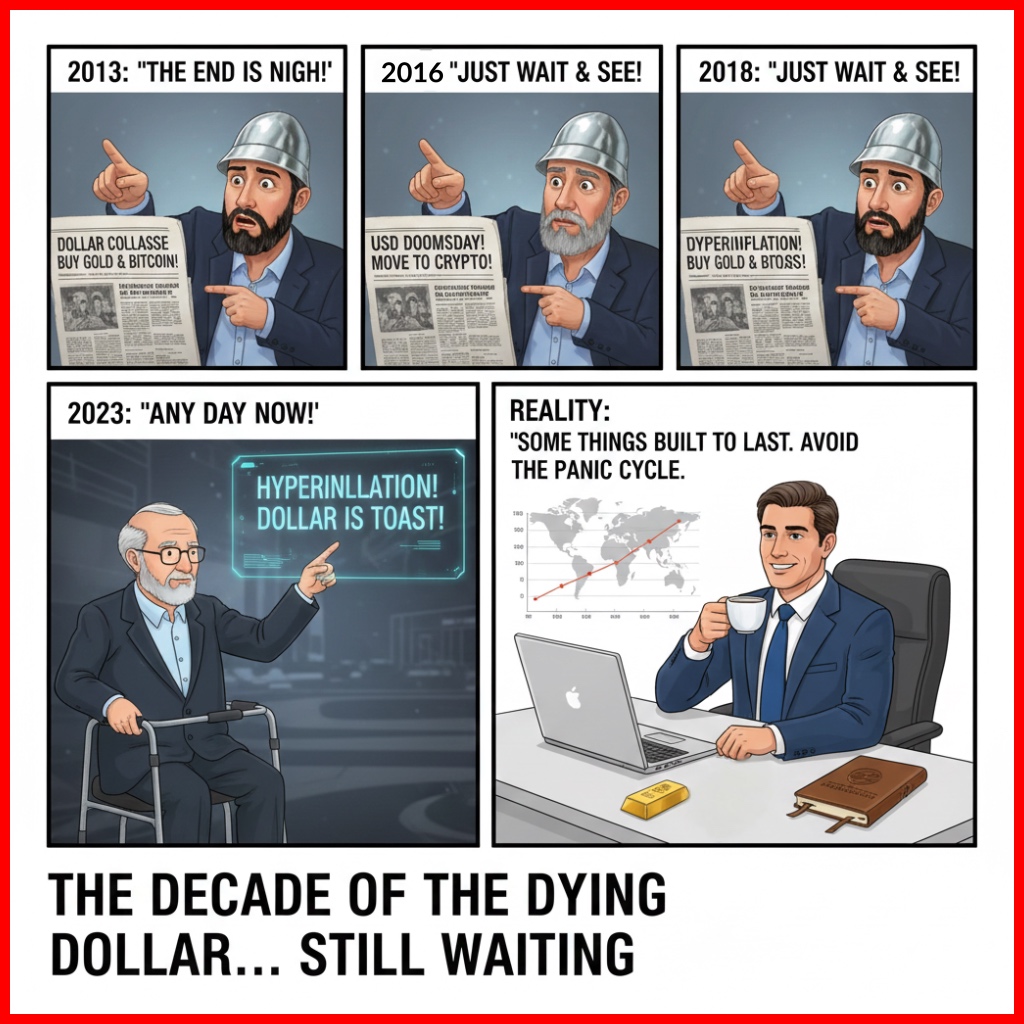

The Decade of the Dying Dollar

For over a decade, the financial zeitgeist has been haunted by the same ghost: the imminent collapse of the U.S. dollar. With each crisis, we’re told we’re witnessing the “end of an empire” — and that the only rational move is to flee into gold, Bitcoin, or Ethereum.

But as a steward of capital and a builder of long‑term arcs, I’m not buying it.

The “death of the dollar” is the most recycled headline in modern history. To the untrained eye, inflation looks like terminal illness. To the strategist, it looks like the predictable — if frustrating — mechanics of a debt‑based system. There is a profound difference between inflationary decay and systemic collapse. One is a headwind to be managed; the other is an apocalypse that has been “six months away” for forty years.

The Fallacy of the “Collapse” Narrative

The primary argument for the dollar’s demise rests on inflation: the dollar has lost over 96% of its value since the Fed’s creation in 1913. Inflation: The Silent Partner You Never Invited

But “collapse” theorists make a fundamental category error. They mistake the devaluation of the unit for the disintegration of the network.

In economics, we must look at the Gresham’s Law paradox. While “bad money drives out good,” the dollar remains the world’s “bad money” of choice because of its unrivaled network effects. A currency’s value is not just found in its scarcity; it is found in its utility.

The U.S. dollar is the operating system of global commerce. Over 80% of foreign exchange trades and nearly half of global trade are invoiced in USD. This isn’t just a preference; it’s a structural dependency. To “collapse” the dollar, you’d have to dismantle the plumbing of every central bank on earth simultaneously.

The Hegemony of Liquidity and the “Full Faith”

Why does the “Full Faith and Credit of the United States” still carry weight despite a $34 trillion debt load? It comes down to deep liquidity and the Eurodollar system.

The U.S. Treasury market is the only market in the world capable of absorbing the massive capital surpluses of nations like China, Japan, and the Gulf States. There is no other “safe haven” asset with the depth to allow a sovereign nation to park $1 trillion and liquidate it in a week without moving the price.

Furthermore, we must account for the Tax Floor. The U.S. government demands its tribute in dollars. As long as the most powerful military and the most productive economy on earth require taxes to be paid in USD, there is a built‑in, non‑negotiable demand for the currency. This is the “Encoded Testimony” of the state — a legal and military guarantee that gold and code, for all their brilliance, do not yet possess.

Hedges vs. Replacements: A Lesson in Position Sizing

It is a mark of intellectual honesty to admit that while the system is powerful, it is also leaky.

Sitting in cash long‑term is not “safe” — it is a guaranteed, slow‑motion clip of your energy. This is where strategic hedges come into play. Gold, Bitcoin, and Ethereum are not “cure‑alls,” but they are essential components of a resilient financial architecture.

- Gold: The “Primitive Hedge.” It represents 5,000 years of consensus as a store of value. It is the insurance policy against total geopolitical fracturing.

- Bitcoin: The “Digital Gold.” It is a masterpiece of scarcity and decentralized verification. It is a bet on the separation of State and Money — a hedge against the specific risk of central bank overreach.

- Ethereum: The “Digital Utility.” It is a bet on the future of programmable finance and the disintermediation of traditional contracts.

But the “all‑in” mentality is the enemy of stewardship. Moving 100% into crypto or gold on a “collapse” headline isn’t prudence — it’s abandoning position sizing. True stewardship respects volatility. If you are 100% in a volatile hedge, you are not managing risk; you are being managed by it.

The Triffin Dilemma and the Global Reserve

Scholarly critique often points to the Triffin Dilemma — the conflict of economic interests that arises between short‑term domestic objectives and long‑term international objectives for countries whose currencies serve as global reserve currencies.

Yes, the U.S. faces a challenge in supplying the world with dollars while maintaining domestic stability. We are seeing a “multipolar” world emerge where the BRICS nations (Brazil, Russia, India, China, South Africa) are seeking alternatives. But the “de‑dollarization” narrative ignores the “Lack of Alternative” problem.

- The Yuan? Capital controls and a lack of transparency make it uninvestable for global treasuries.

- The Euro? A currency without a unified fiscal backstop is a house built on shifting sand.

- Bitcoin? Still too volatile to serve as the unit of account for global oil shipments.

We’re in a “least‑dirty shirt” contest — and the dollar still has the strongest detergent.

Building on Rhythm, Not Panic

My philosophy is built on Rhythm. The market has cycles; the debt has cycles; the headlines have cycles. If you trade on the cycle of the headline, you will always be late and you will always be afraid.

Stewardship requires us to look at our “Financial Arc” with a 50‑year lens. In that timeframe:

- Concentrate on Quality: Own the businesses that have pricing power (equities).

- Hold Hard Assets: Keep a percentage in Gold and BTC to capture the “scarcity premium.”

- Respect the System: Use the dollar for what it is — a highly liquid, globally accepted tool for transaction and tax settlement.

The Final Question: Assets or Headlines?

The “end of the dollar” is a profitable narrative for those selling newsletters, gold bars, and “get‑out‑now” courses. It preys on the primal fear that the ground beneath our feet is liquid.

But look at the data. Look at the network effects. Look at the sheer gravity of the U.S. financial system. The dollar isn’t going away overnight. It’s evolving, competing, devaluing — but not collapsing.

Are you buying assets — real, productive, value‑generating assets? Or are you buying the recycled panic of a decade‑old headline?

Build on the bedrock of stewardship. Leave the panic to those who haven’t studied the architecture.

Financial Blueprint To Freedom

Comments

Post a Comment