Law #33 for Investors: Find Your Thumbscrew

💡 Law #33 for Investors: Find Your Thumbscrew

In the realm of power and politics, mastery often depends on knowing where to press—the lever that moves others to action.

In finance, however, the true challenge is different. It’s not about mastering others; it’s about mastering yourself.

In investing, self-mastery begins with identifying the trigger that leads you toward ruin. Every investor has one, and finding it is the first step to protecting your capital.

The Thumbscrew Defined: The Whisper of Akrasia

Every investor carries a “thumbscrew”—a behavioral weak spot, that moment when discipline slips and impulse takes control.

The ancient Greeks had a word for it: Akrasia—knowing the right thing to do, but doing the opposite. It whispers through:

- The sudden itch to splurge on a non-essential.

- The rush of excitement that makes you chase a volatile, trending stock.

- The quiet, dangerous permission of “just this once.”

Your thumbscrew is that psychological pressure point where logic yields to emotion. When squeezed, it compromises your long-term strategy for short-term gratification. Recognizing it is the beginning of behavioral investing discipline.

🛡️ Strategic Self-Defense: Build Friction Around Your Impulses

Once you identify your thumbscrew, the solution isn’t “more willpower.” Willpower is finite, fleeting, and unreliable. The real solution lies in **designing friction**—creating systems that make it harder to act on destructive impulses.

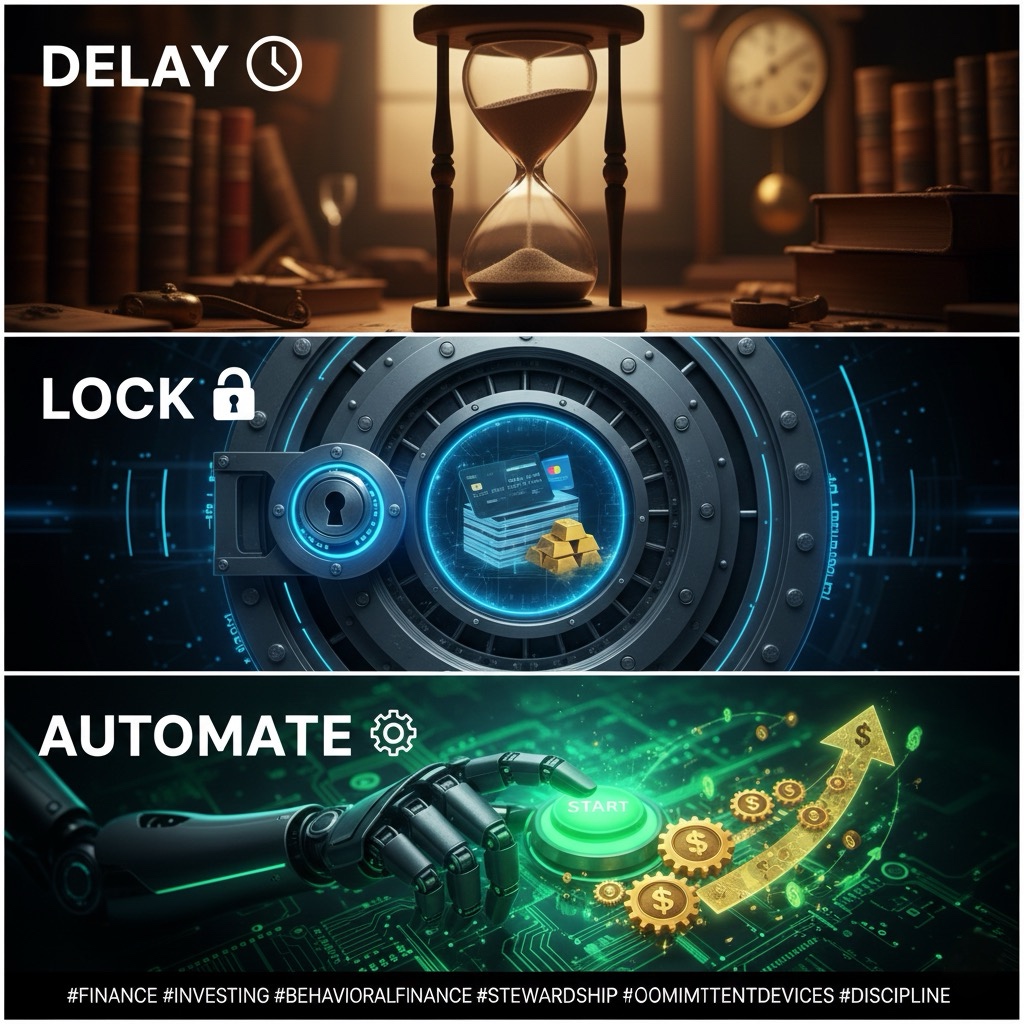

Here are three mechanisms to protect your portfolio from yourself:

1. Delay (The 24-Hour Cooling-Off Rule)

For any non-essential purchase or spontaneous, high-risk trade, impose a mandatory 24-hour wait. Most financial urges fade quickly; delay turns a hot impulse into a cold decision.

2. Lock (Separate Your Capital)

Segregate your money mentally and physically. Keep long-term capital—retirement funds, core index investments—completely walled off from any account you trade in. Guard your future gains from momentary thrill-seeking.

3. Automate (Pay Yourself First)

Set up automatic transfers to your investment accounts immediately after payday. This removes decision friction entirely—you invest before temptation even has a chance to whisper.

Why Automation Works:

Compounding isn’t just math—it’s behavioral armor. Automation bypasses emotion, locks in discipline, and lets growth happen quietly while you focus on the long game.

The Final Test

Remember this simple truth:

- Markets test your strategy.

- Compounding tests your discipline.

A brilliant investing plan is worthless if behavior undermines it. So, find your thumbscrew. Build friction around your weaknesses. Then let the mathematics of compounding—and your engineered discipline—do the heavy lifting.

Master your thumbscrew, and you master the compounding game.

Comments

Post a Comment